There are more options for consumers to buy food. The same corporate parents own many of the formats, but the market is becoming more fragmented. This means more options for producers and processors to find the right fit in the marketplace. One of the fastest growing segments in our Canadian retail landscape is discount. This was reinforced recently with Sobeys’ announcement that they will be converting 77 stores in Western Canada to FreshCo. Consumers have embraced these low-price stores with limited assortment and few staff on the floor to help.

Discount stores

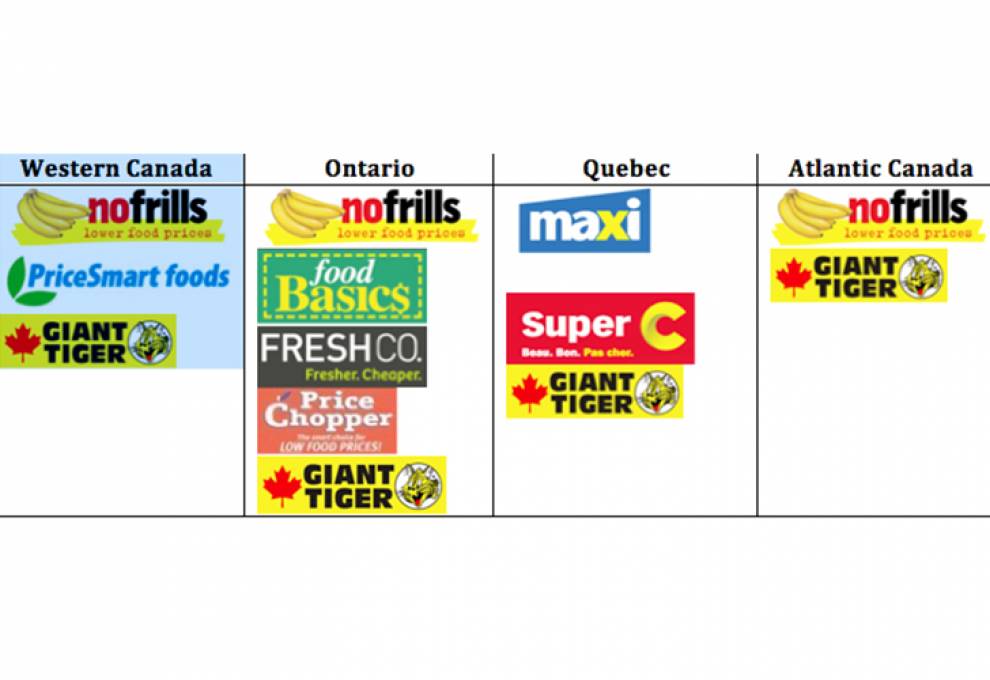

Discount stores are not new to our Canadian retail landscape. No Frills has been a force in the market for many years. The three large Canadian food retailers each own discount banners; Loblaw has No Frills and Maxi in Quebec, Sobeys has FreshCo and Price Chopper in Ontario and Metro has Super C in Quebec and Food Basics in Ontario. Overwaitea operate Price Smart stores in Western Canada. We continue to see more food sold in Giant Tiger, which straddles the mass merchant/discount segments. If you have not been in one of these stores recently they are selling a lot of food.

The stores all operate on the same principles, which are:

- Lowest prices

- Limited assortment

- Reduced labour

- Low fixed and variable costs

Low prices are the cornerstone of the model. They drive traffic and turn inventory. The stores will protect their price image with a vengeance and if they are perceived to be even the highest in the segment of the market, they will lose sales. Price conscious consumers have options and usually the attribute that brought them in will take them elsewhere.

The limited assortment reduces shrink and the cost of paying for and merchandising slow-moving items. Reduced labour will prove to be a bigger advantage over the traditional stores as labour costs continue to rise and also just the cost of attracting help is going up. The low fixed and variable costs are realized with less expensive fixtures, lower priced real estate and even fewer lights. The winners in this segment do the most volume with the lowest margins. One of the hallmarks of a great discounter is that the quality does not suffer. When consumers perceive they are getting the same quality fresh (onion to onion or pork chop to pork chop) that they get in conventional stores the discount will usually win most of the consumer’s food dollars.

Other markets have also experienced growth in the discount segment. Large global chains such as Lidl and Aldi have moved into many markets with disruptive results.

Selling to discount stores

To find success selling to this segment you really just have to go back to the four principles we reviewed earlier. The first priority will be price. Your product must be priced at or below the category to have success in discount. This is the spot if you have the efficiencies, cost of production and low overhead to make you a price leader in the market. The merchants in these banners will be relentless on cost, which is their job. They have to get the best price so they can sell it for the lowest price.

They are only interested in your best selling SKUS. If you have three SKUS where your margin is highest on the lowest selling item, you should understand they might not take them all and you will be left selling only the lower margin product(s). This is not usually the best place to introduce new items. The items need to sell themselves and not rely on demos, over and above merchandising or other initiatives that require labour.

When considering this segment of the market it is important to remember there is not a lot of labour in these stores. If your item requires something extra it is likely that it will not happen. If it is drop and go it will probably get more opportunities.

Make sure you understand the fixtures where your item(s) will be merchandised. They are often different than conventional stores. They are always looking for opportunities to reduce labour so displaying items right in the shipping case is often preferred.

Opportunities

If you have an opportunity where you can offer an attractive price, these stores are a great fit. They can move a lot of volume. You do have to remember that they will do whatever they can on price to drive traffic, which can have an impact on your sales and relationships with other stores. A low retail price in discount stores will move a lot of cases, but you have to understand the impact across the entire market.

Different sizes are an effective tool in the discount segment. If you can produce an item where they can deliver exceptional value and it is difficult for consumers to compare to their own store, there is a greater chance everyone will win. Ideas such as banded packs or a second label will also deliver sales for you without alienating your other customers.

The resources at the office are similar to the resources at the store. They cannot afford a lot of people so if you plan to sell to these retailers do not expect a lot of personal contact from the office. They have a lot to do and they do not have much time for the ‘extras.’

If you have any questions about selling your products in traditional food stores please give me a call at (902) 489-2900 or send me an email at peter@skufood.com. Next month we will explore specialty stores.

RETAIL NEWS

Will 2018 be the year for home delivery?

It will be very interesting to watch the developments as Canada’s major retailers compete for the lucrative convenience conscious consumer. These shoppers, who are willing to pay more, will have the opportunity to have their groceries delivered right to their door in the largest markets. This is not new, but the difference in 2018 will be that almost every major chain will be offering the service.

Retailers want these shoppers because they usually have the weekly orders with the highest margin items so the store makes more profit. They also want them to start shopping online with their banner, because the retailer can begin to build a profile and offer these lucrative customers a prepopulated list to make their shopping even easier. Usually they do not switch for price so it is up to the retailer to execute and keep them as a lucrative, loyal shopper.

We will have to watch carefully to see how many people take advantage of the home delivery services being developed and who wins the battle for these shoppers. The race to defend their turf from the looming Amazon effect continues.

Add new comment