For a decade, Ontario asparagus and melon grower Mike Chromczak has used the Advance Payment Program (APP) to access $100,000 interest-free. Up to $1 million can be borrowed under competitive terms. It’s a federal program that he says should be used more because of the lack of bureaucracy.

“Inflation has bitten us hard, so being able to borrow money efficiently is important,” says Chromczak, chair of the safety nets committee, Ontario Fruit and Vegetable Growers’ Association (OFVGA). “The team at the Agricultural Credit Corporation is farmer-friendly. The program has become so streamlined that I can call and have my line of credit updated in 10 minutes.”

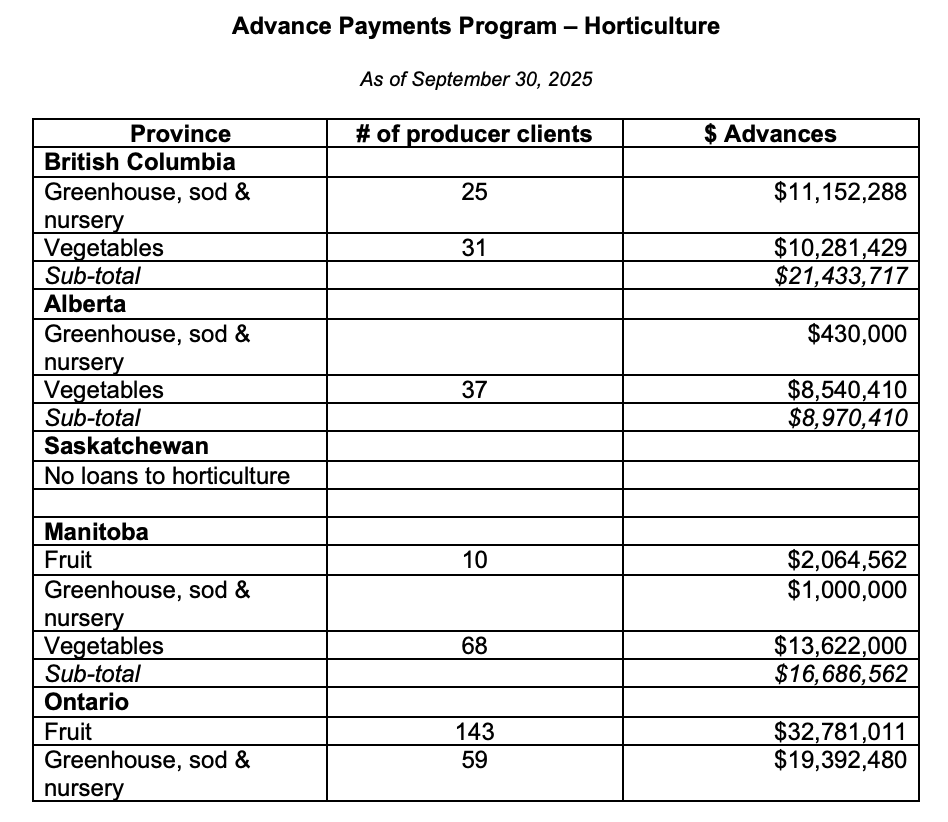

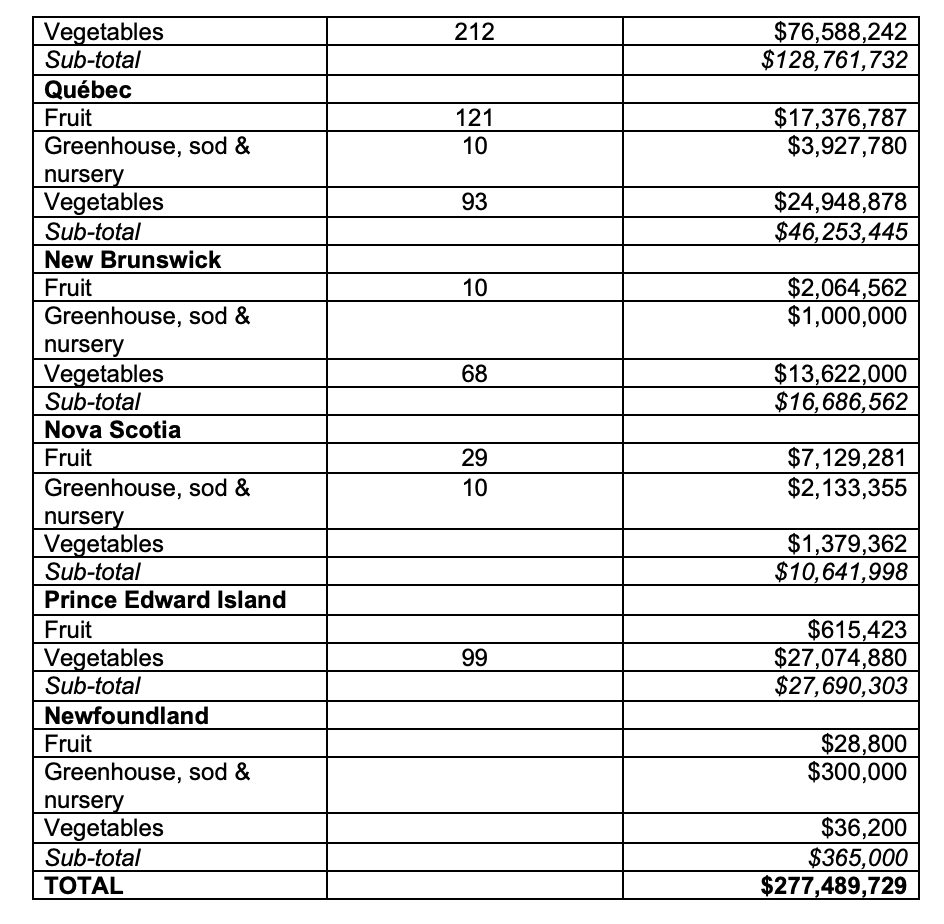

That’s high praise for the Agricultural Credit Corporation (ACC) helmed by CEO Jaye Atkins based in Guelph, Ontario. His team oversees 4,000 loans across Canada valued at $1 billion. As a recent Agriculture and Agri-Food Canada report shows, among horticulture accounts, Ontario is the biggest user of the program with $128.7 million in loans. Québec is the next biggest user with $46.2 million in loans. Prince Edward Island is the third biggest user with $27.7 million in loans. In total, APP has loans valued at $277.5 million to horticultural producers as of September 30, 2025.

The APP is a federal loan guarantee program which provides agricultural producers with easy access to low-cost cash advances. Under the program, farmers can access up to $1,000,000 in total advances based on the value of eligible agricultural products and those in storage. Normally, the Government of Canada pays the interest on the first $100,000 of the advance. But at the agriculture minister’s prerogative, the first $250,000 has been interest-free for the 2024 and 2025 program years. The deal is that farmers with storable crops must repay the loan within 18 months. Otherwise, the repayment is due December 30.

According to Stefan Larrass, senior policy advisor, OFVGA, advocacy efforts are underway to make the interest-free portion permanent at $350,000 to reflect increased costs of production in an inflationary environment. As it stands, ACC must wait for the minister’s decision, usually about two weeks prior to the roll-out of the government’s new fiscal year April 1. And this uncertainty impacts growers who are liaising with banking institutions for their total financing needs.

“For us, we need to have the budgets set for government, other banks and boards,” explains Atkins.

ACC followed the fall 2025 announcement of Bank of Canada’s lowered interest rate and adjusted its prime rate to 4.45 per cent as of October 30. The loan rate is calculated at approximately 50 per cent of the projected farmgate value of the commodity. It takes about 10 to 14 business days to process the application. Another advantage is that because the APP program is government funded, it is paid before banks in case of a bankruptcy.

As Larrass notes, “This is not your grandfather’s loan program. The four-page application can be completed with a phone call and you can save $20,000 in 30 minutes.”

“This Advance Payments Program should be part of every farmer’s financial suite,” states Chromczak. “No collateral is required other than the value of the crop. The program offers interest-free money to pay your upfront costs of seed, fertilizer and packaging materials early in the season.”

For more information, call 1-888-278-8807.

Source: Agriculture and Agri-Food Canada